Trump Tax Cuts and the Middle Class for a Family of Two

Ii years after Trump tax cuts, middle-class Americans are falling backside

- Over the next two years, income for middle-form Americans is projected to abound at less than half the charge per unit as for the richest 1%, a recent Congressional Budget Office found.

- The country's height-earning households volition also relish a bigger reject in tax rates than all other groups.

- Every bit a result, income inequality in the U.Southward. — already at a fifty-year high — is expected to worsen.

Income for middle-grade Americans is growing more slowly than for both top earners and the poor, co-ordinate to the Congressional Upkeep Office. The analysis comes two years afterwards President Donald Trump enacted the Tax Cuts and Jobs Act, a major overhaul in the nation's tax laws billed by the White Firm every bit a boon for the centre class.

After accounting for taxes and government benefits, the middle fifth of households will see their income grow by 6.6% through 2021, the CBO forecast — that compares with a 17% proceeds projected for America'southward richest workers. In dollars and cents, the middle 20% of families will have seen their income grow a total of just $iv,400, to $70,300, between 2016 and 2021, the agency estimated.

Income for the meridian one% is expected to rise near $200,000 over that same v-year period to well-nigh $1.4 million; the lesser xx% could meet their annual income grow a total of $1,700 to $36,700.

The analysis factors in the impact of taxes and of government "transfers," which include benefit programs such as Medicaid and food stamps (but exclude social insurance programs like Social Security).

Thanks to the Tax Cuts and Jobs Act, top earners are also expected to become the biggest overall reduction in taxes over the 5-yr period studied by the CBO — their revenue enhancement rate is projected to slide by 3 percentage points over the next two years, versus a dip of just 1 percentage signal for the lesser 95% of earners, according to the CBO. The tax rate for households in the 96th to 99th percentiles is expected to autumn past two per centum points.

The findings may fuel criticism that the panthera leo'due south share of the gains from the 2017 tax constabulary has gone to the rich and to corporations. The analysis also calls into question whether the nation'due south ongoing economic expansion — now in its 10th yr — is significantly improving virtually Americans' standard of living, analysts said.

"Significant improvements in the quality of life of the middle class are not likely to come from general economical growth, or at least not someday before long," wrote Brookings senior fellow Richard Reeves and inquiry analyst Christopher Pulliam in a web log postal service assessing the CBO'southward projections.

To exist sure, the gap betwixt rich and poor has been widening for decades in the U.S., with the CBO noting that the tiptop 1% enjoyed much faster average income growth from 1979 to 2016 than other groups.

Interestingly, before taxes and transfers, income growth since 1979 for both the lowest-earning and tiptop-earning Americans has outperformed the heart-class — a trend the CBO expects to go on. Over the next two years, income for the bottom 20% of earners is forecast to grow half-dozen.3% and to jump 12% for those at the top. That compares with a projected 5.8% income gain for the middle 20%.

Why the eye class is losing footing

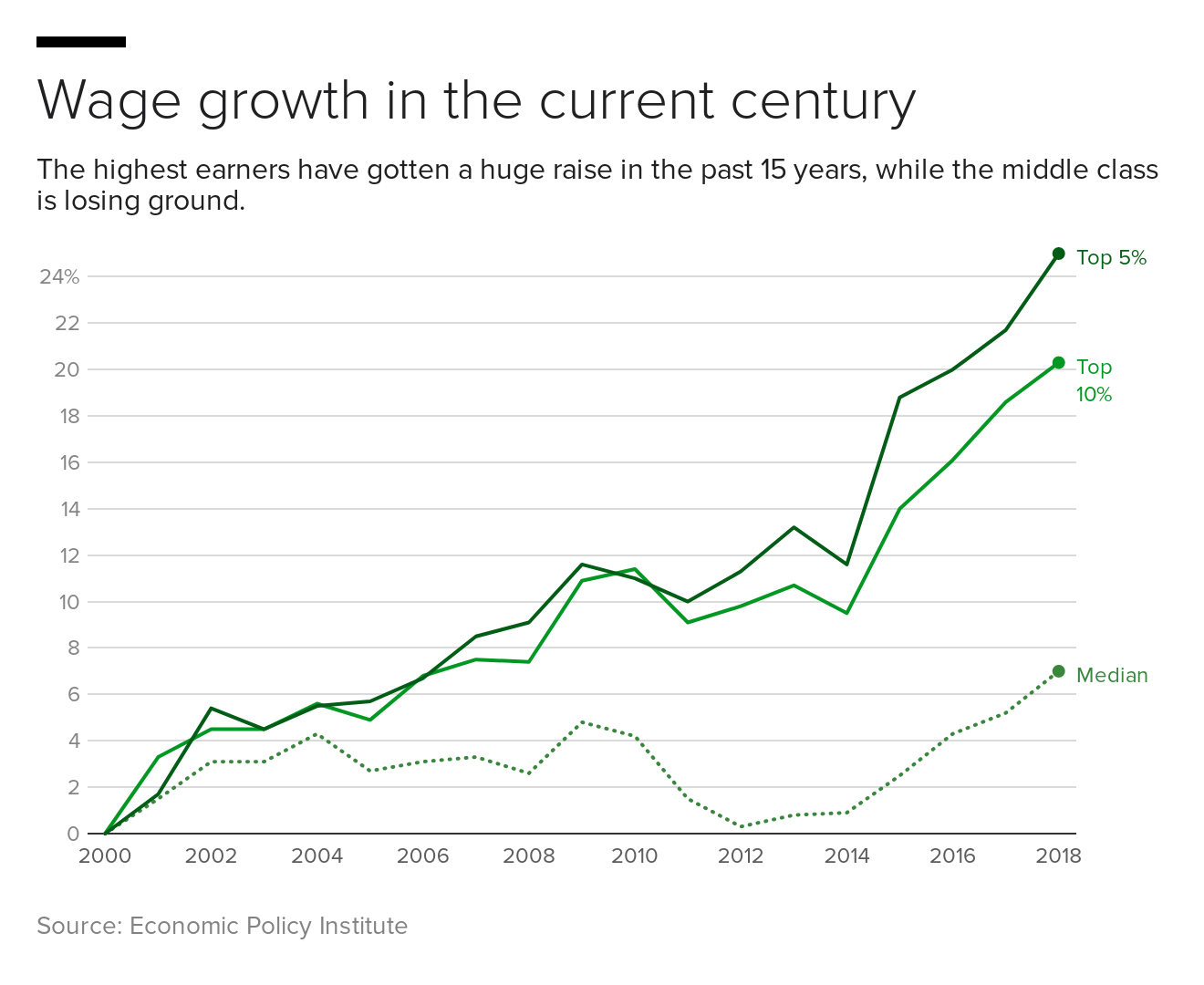

Several factors are widening the gulf betwixt the centre class and the rich in the U.S., the CBO says. Most important, meridian earners are grabbing a larger share of the nation's overall income, which could be due to "superstar" workers and meridian executives receiving huge pay packages, according to the non-partisan bureau.

Secondly, capital gains — the income earned from belongings or investments like stocks — have grown much faster than the income from labor. In other words, a rank-and-file worker can't hope to lucifer the income booked by a wealthy investor'due south portfolio. Income from labor volition grow at an average almanac rate of one.three% between 2016 and 2021, while capital letter gains will increase at an almanac rate of half dozen.iii% over the aforementioned period, the CBO estimates.

That trend overwhelmingly favors the rich. The CBO notes that capital gains contributed less than 2% of income for the bottom 99% of U.South. income earners, simply accounts for 22% of the total income for the state's richest 1% of households.

Stuck in the middle

The Taxation Cuts and Jobs Act gave large taxation breaks to corporations, lowering the business tax to 21% from 35%. That's allowed corporations to spend hundreds of billions repurchasing their own stock, which helps investors, and boost dividend payments.

The law besides gave a valuable revenue enhancement suspension to some professionals through what'southward known as the "pass-through" deduction, which allows them to lop off twenty% of their income earlier paying the IRS.

At the same time, the lowest-earning Americans are seeing college pay equally more states and cities boost the local minimum wage. Labor movements such as the Fight for $15 are also putting pressure on low-wage employers to increase their hourly rates.

That leaves the middle form without visible means of catching up to the acme-earning Americans, while too trailing the gains eked out past the poorest workers.

It could take "concerted efforts" to reverse the stagnation that the center grade is probable to see over the next several years, the Brookings experts said. For instance, new policies such as expanded tax credits and assist with housing costs could assistance heave growth for this group, they noted.

Source: https://www.cbsnews.com/news/two-years-after-trumps-tax-reform-the-middle-class-is-struggling/

0 Response to "Trump Tax Cuts and the Middle Class for a Family of Two"

Post a Comment